Intel reconfirmed its commitment to the consumer market during its Q4 2025 earnings, despite a heavy focus on wafer supply shortages and increased demand from the data center and AI markets. The company is shifting its internal wafer supply to the DCAI segment while relying on external wafer supply for CCG (Client Compute Group).

Responding to a question about weaker-than-expected DCAI outlook, David Zinsner, Chief Financial Officer at Intel, said: "We're shifting as much as we can over to the data center... we can't completely vacate the client market." Intel CEO Lip-Bu Tan also highlighted shortages affecting other areas, saying, "The industry is facing a very big challenge, you know, the memory constraints and the pricing."

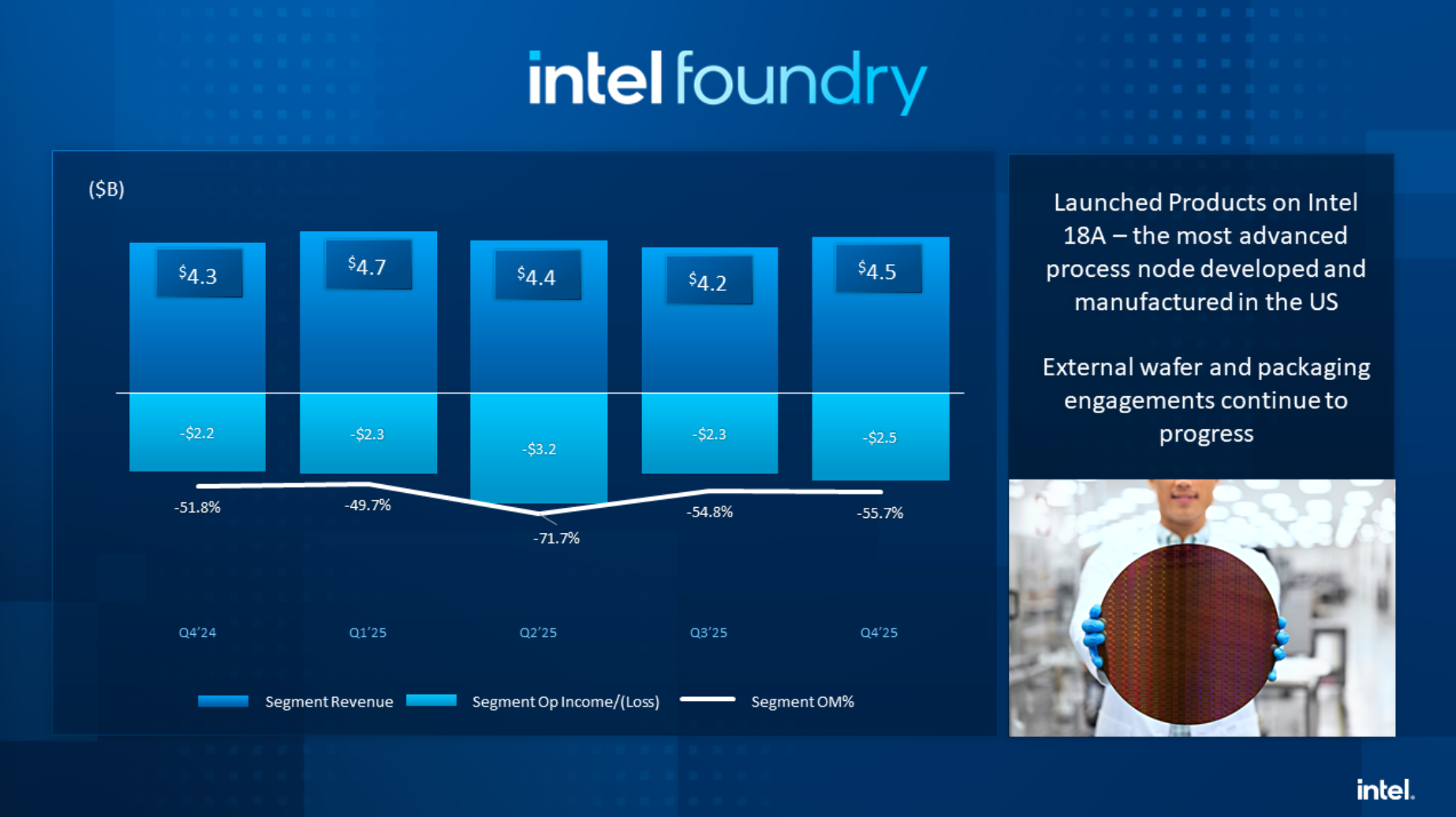

Although Intel has technically shipped 18A, Tan still recognized yield shortfalls facing Intel's cutting-edge node. "I'm disappointed that we not able to fully meet the demand of our markets... yields are in-line with our internal plans, [but] they're still below where I want them to be," the executive said. Tan said yields are improving for 18A month-over-month, targeting a 7% to 8% improvement each month — a pace that Intel hopes will reduce per-unit pricing.

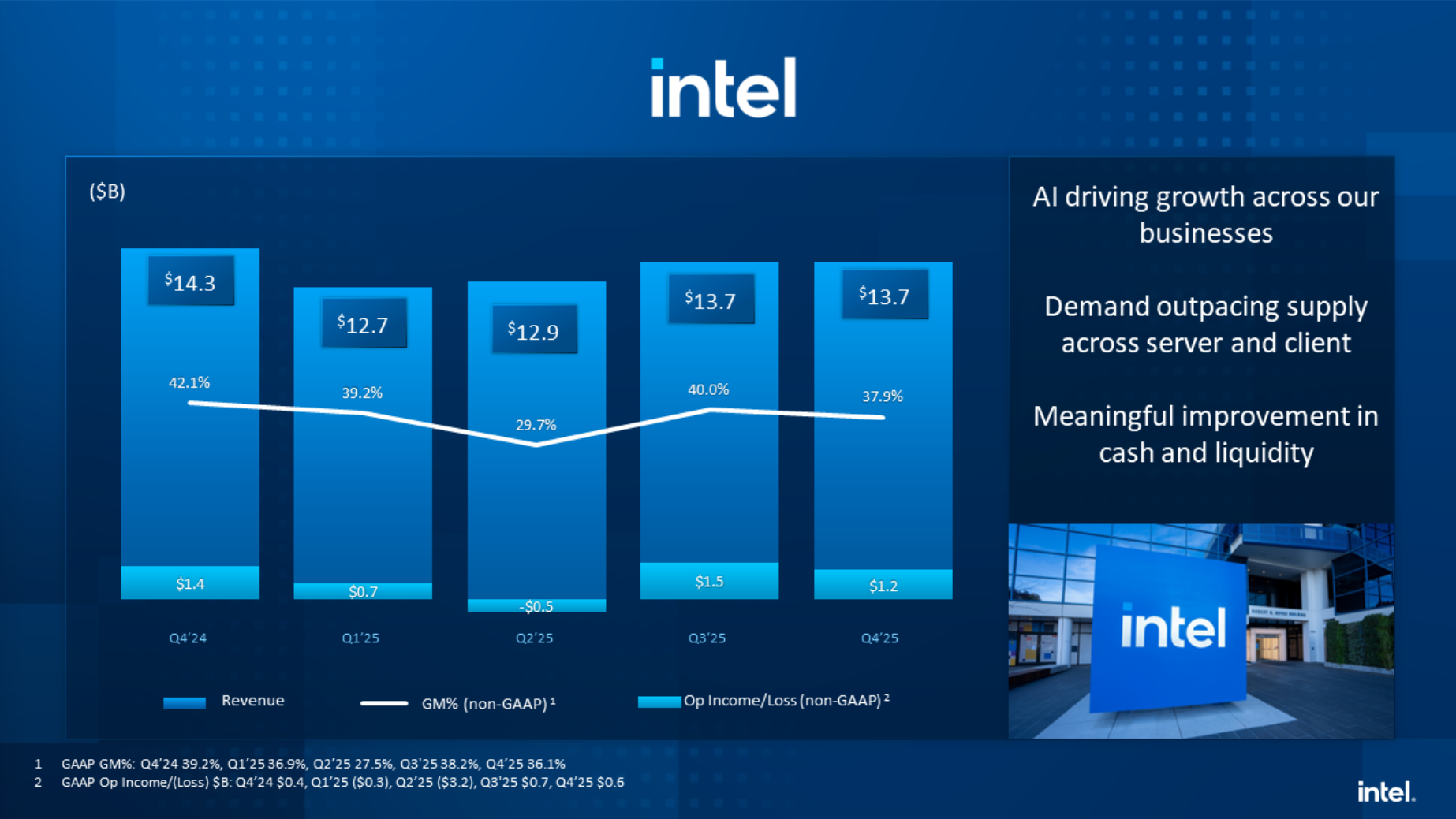

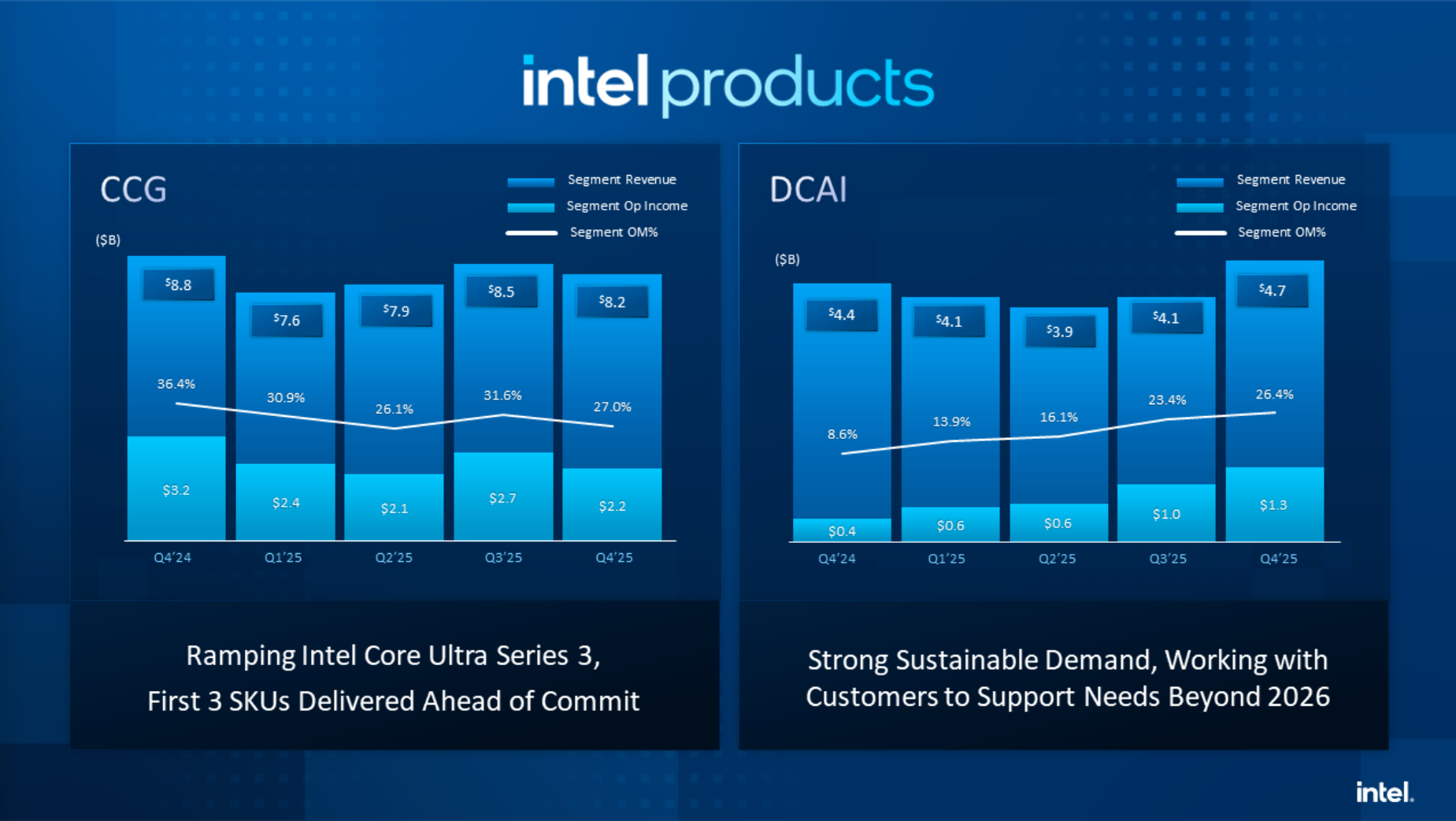

Overall, Intel's Q4 revenue was $13.7 billion, down 4% year-over-year. For full-year 2025, Intel is flat year-over-year. More interesting are the business unit splits. For CCG, Intel posted $8.2 billion for Q4, which is down 7% year-over-year, dragging down CCG's year-over-year revenue for the full year of 2025 by 3%.

Although the DCAI business group represents about half of the revenue of CCG, it saw growth in Q4. With revenue of $4.7 billion for the quarter, it's up 9% year-over-year. For the full year, DCAI revenue came in at $16.9 billion, which is up 5% year-over-year.

It's a growing business unit, though not growing at nearly the rate of Intel's competitors. AMD hasn't shared full-year earnings for 2025 yet, but it posted a 22% year-over-year growth in its data center segment in Q3 2025. Meanwhile, Nvidia posted 25% improvements quarter-over-quarter and a 66% boost in year-over-year revenue for its data center segment.

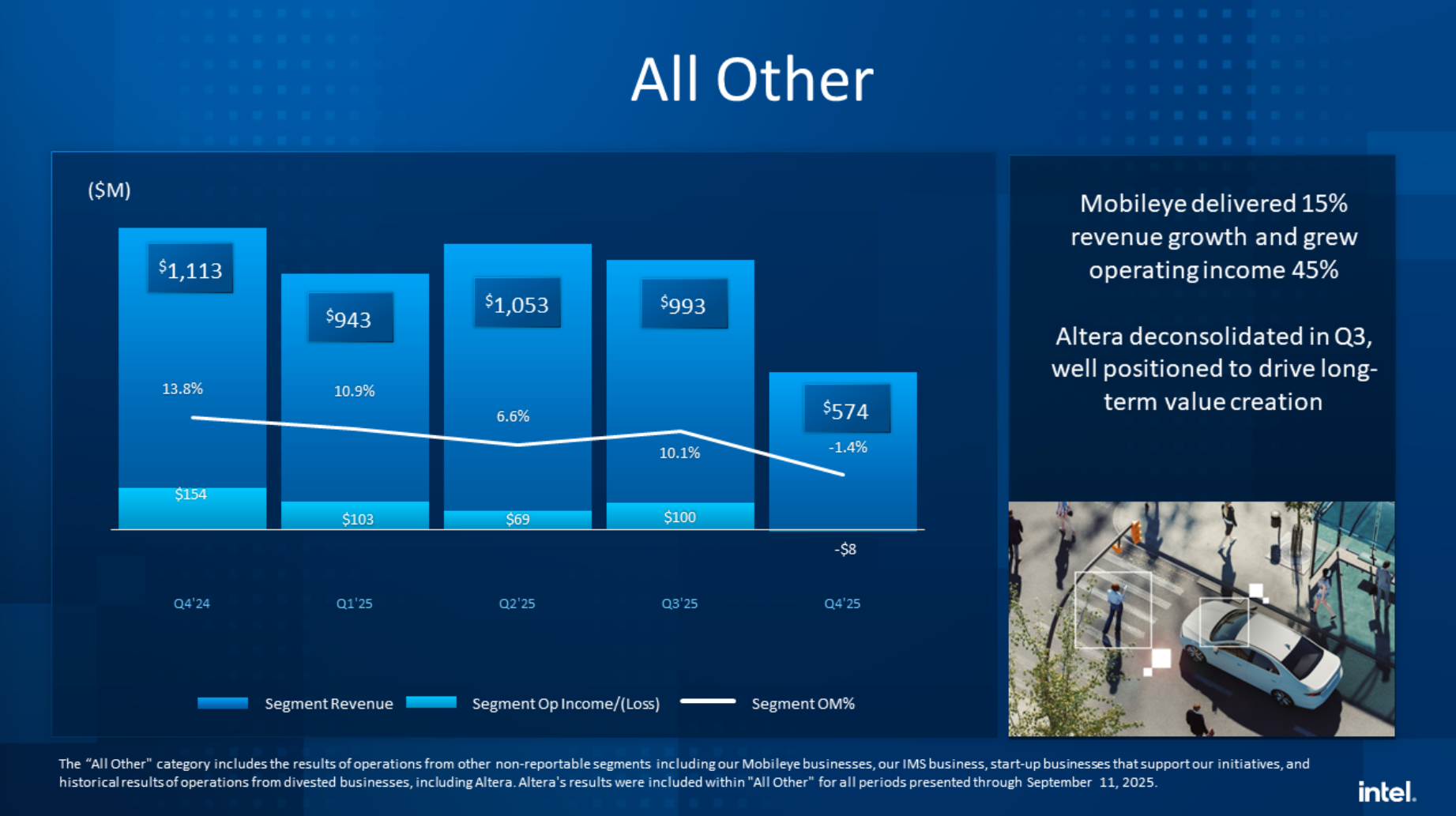

For Intel Foundry, despite an improvement in segment revenue of 4% year-over-year, the operating margin for the quarter was -55.7% , with $2.5 billion in losses. For Intel's other businesses, which it rounds up under the "All Other" segment, Intel posted a loss of $8 million dollars and revenue that is down 48% year-over-year, primarily driven by the deconsolidation of Altera — an FPGA subsidiary that Intel wholly owned until September 2025.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

.png)

1 week ago

31

1 week ago

31

English (US) ·

English (US) ·